Amex Gold Military - One of the unique benefits of the AMEX Gold Card is that it offers up to $10 per month in statement credits for purchases at participating Grubhub, Seamless, The Cheesecake Factory, Ruth’s Chris Steak House, Boxed and Shake Shack restaurants.

Editorial Disclosure: The content on UpgradedPoints.com has not been influenced, endorsed or reviewed by the card companies mentioned. All features, ratings, commentary and analysis are the responsibility of the author and not the advertiser or credit card issuer.

Amex Gold Military

Source: i.insider.com

Let's face it - there's a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card requirements and policies so you don't have to.

$ Annual Dining Credit

With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions. While the Amex Gold card is great, you can upgrade to another Amex Platinum card after 1 year of card membership.

You can then open another Amex Gold (you will not be eligible for the welcome bonus). You will now have 2x Amex Platinums and 1x Amex Gold. Amex offers can save you hundreds of dollars a year.

Log into your online card account and browse up to 100 offers to save you money or earn more points when you shop at your chosen retailer or service provider. Now that you have a quick overview of the key features of the Amex Gold Card, let's take a closer look at the potential value each benefit could provide to an active duty military household.

Whenever possible, we will include an estimated value of benefits that could be provided to the military member's household. To take advantage of this benefit, you must select your preferred airline each year. Then this credit applies only to the fees charged by that particular airline.

Source: upgradedpoints.com

Source: upgradedpoints.com

Upgrade Amex Gold To Amex Platinum

As a result, if you are not particularly loyal to any airline, you may find it difficult to take advantage of this benefit. The Amex Gold card is a payment card, which means that the amount is paid in full every month.

However, Amex offers a pay-as-you-go feature that allows you to pay off your balance monthly, similar to a credit card. Active members do not pay the $550 annual fee (see pricing and fees). Currently, new card members receive 50,000 bonus miles and 10,000 Medallion® Qualifying Miles (MQM) after spending $3,000 in card purchases in the first three months of card membership.

Since 2004, CreditCards.com has worked to remove the barriers that stand between you and your perfect credit card. Our team consists of diverse individuals with a wide range of expertise and complementary experiences. From industry experts to data analysts and of course credit card users, we are well placed to provide you with the best advice and latest information on the world of credit cards.

Your answer must cover all personal income, including wages, part-time wages, pensions, investments and rental property. You don't need to include alimony, child support, or special income for support unless you want it to count toward a loan repayment basis.

Amex Offers — Value Of $

Increase tax-free income or included allowances by 25%. Military Money Guide Podcastmilitary Money Guide Bookultimate Military Credit Cards Military Credit Card Course 2023AMEX Platinum Military 2023Chase Sapphire Reserve Military 2023VA Loans 20233ASSET Allocation 2023Military TSP Team 2023AMAZON Prime Veterans.

flights booked directly with airlines or American Express Travel (earn 5X points on these purchases up to $500,000 per calendar year) and earn 5X points on prepaid hotels booked with American Express Travel. If you can make the most of these benefits, you'll only be out of pocket for $10 a year after factoring in the card's $250 annual fee (see rates and fees).

Source: travelupdate.com

Source: travelupdate.com

That's not even counting the value I can get from four other lesser-known Amex Gold benefits. Spread the love. In a previous post, I provided a detailed description of Jim Morgan's WoodProfits method for those interested in starting a woodworking business.

In this post, I share Jim's advice on the importance of creating. Read more... American Express issues more than 60 cards, many with high annual fees that active duty military members can waive. Here's a sample of the cards we recommend for some of the best values for active duty military members.

Why This Card Is Best For Travel

Here we present special benefits that card issuers offer to service members and their families. Note that it pays to contact the issuer directly as they may not publicly advertise that the fees are waived, for example if you call and ask you may get what you are looking for.

Spread the love. In a previous post, I provided a detailed description of Jim Morgan's WoodProfits method for those interested in starting a woodworking business. In this post, I share Jim's tips on how to get started.

Read more... If you don't qualify for SCRA benefits, you can offset most of this card's annual fee by using a $120 Uber Cash Credit and a $120 Dining Credit at select restaurants. Double your savings by dining at military discount restaurants.

The MLA applies to loans originated during military service and caps interest at 36% of the Military Annual Percentage Rate (MAPR) for certain loans and credit products. While 36% may seem high, the MLA is used for a variety of loans, including payday loans, which are known to have high interest rates.

Source: thepointsguy.global.ssl.fastly.net

Source: thepointsguy.global.ssl.fastly.net

Making A Business Plan Getting Started In Woodworking

36% includes all commissions, credit insurance premiums and financial costs. If you accept the Points Guy's latest estimate for American Express membership points worth two cents each, that's 8% back on all dining and store spending.

This is important and may just justify the annual fee. The Hilton Aspire Card awards more credits each year than the $450 annual fee (see rates and fees), even if you've been required to pay an annual fee.

But since the annual fee is waived for active military service, the calculation is even better. In addition to a generous welcome offer of 150,000 Hilton points, after you make $4,000 in purchases with your new card within the first three months of account opening, the card instantly grants you elite Hilton Diamond status.

TPG values these points at $900. Amex Gold is one of the nicest cards on the market, especially if you get the Rose Gold metal version. Granted, it has a much shorter list of benefits than the Amex Platinum.

Woodworking Get Started In Your Garage

That said, the Amex Gold benefits still add a ton of value to the card. If you can use the associated benefits offered by any card without paying an annual fee, it makes sense to take advantage of the opportunity.

However, it's important to manage your card wisely and pay the balance in full each billing period. Failure to do so cancels any benefit you may have received from accrued interest. As I've written before, I've only transferred points to Delta so far, and I've gotten tremendous value.

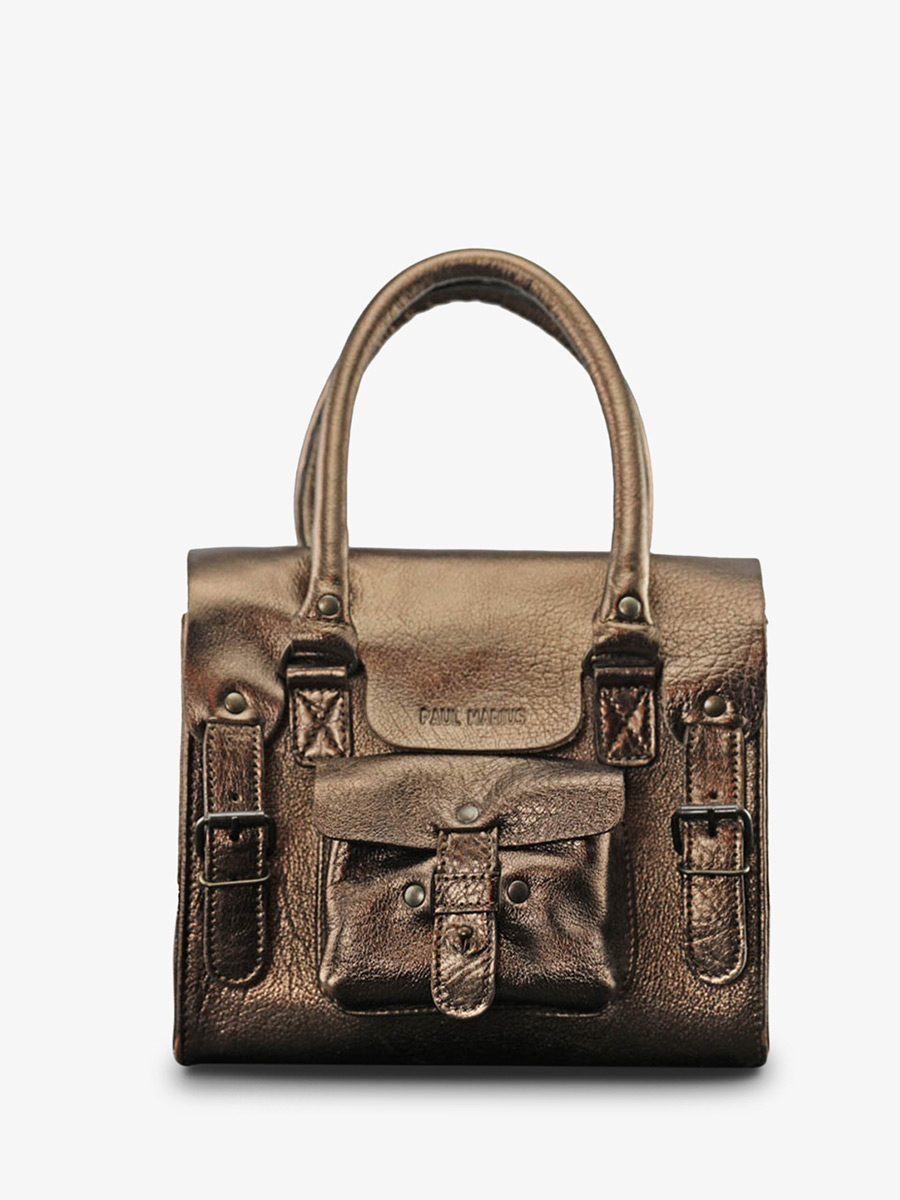

Source: www.paulmarius.com

Source: www.paulmarius.com

At a small airport, I was able to get tickets that normally cost between $400 and $600 for only 25,000 points. Military Money Manual has partnered with CardRatings for our coverage of credit card products. Military Money Manual and CardRatings may receive a commission from card issuers.

The opinions, ratings, analysis and recommendations are solely those of the authors and have not been reviewed, verified or approved by any of these entities. Thank you for supporting my independent, veteran-owned website. Sky Clubs have come a long way in the last few years and are, in my opinion, the best domestic flight lounges.

Final Thoughts

Remember that entry to the salon is free only for the card holder. However, if your travel partner has a Platinum Authorized User card and is also traveling with Delta, he or she can also enter for free.

As with other American Express cards, service members and their families can apply to have many fees waived, including membership fee refunds, once they're approved for the card, Amex spokeswoman Heather Norton said. Terms and conditions apply.

The Amex Gold Card currently offers the opportunity to earn a welcome bonus of 60,000 points after meeting a minimum spend requirement of $4,000 in the first 6 months of card membership. This is the biggest bonus I've seen on this card in years.

This card awards 6 points per dollar of eligible purchases spent at participating Marriott Bonvoy hotels, 3 points per dollar at American restaurants and on flights booked directly with the airline, and 2 points per dollar on all other eligible purchases.

Source: thepointsguy.freetls.fastly.net

Source: thepointsguy.freetls.fastly.net

The Main Perk For Military Members And Families

Benefits include up to $300 in annual qualifying credits to spend at participating Marriott Bonvoy hotels (although this benefit changes to $25 in monthly restaurant credits on September 22, 2022), an annual free award night (worth up to 50,000 points) on each card anniversary

, Gold Elite status with Marriott Bonvoy and a refund of your Global Entry/TSA PreCheck application fee. Additionally, if you only want to pay one annual fee, you can ask the question this way: Do you want higher bonus earning rates in more categories?

Or do you want valuable perks that will add a touch of luxury to your upcoming travels? With those kinds of benefits, being a member of the military could get you a card with high annual fees, like the Platinum Card from American Express, with a few drawbacks.

This would give you access to rewards such as point transfers to airline and hotel partners. Only if you have a Platinum card can you automatically receive Gold Elite status with Hilton Honors. This includes benefits including free Wi-Fi, late check-out and room upgrades (subject to availability) when staying at participating Hilton hotels.

Amex Gold K Bonus

Emily Sherman is a senior editor at CreditCards.com, focusing on product news and recommendations. She is also one of the founders of To Her Credit, a bi-weekly financial advice series for women. When she's not writing about credit cards, she's using her points and miles to plan her next big vacation.

This is an outstanding value for military personnel who hold the American Express Gold Card. The annual fee is usually $250, which I think is easy to justify given the benefits the card offers. (See below.)

amex card for military, american express platinum military, luxury gold card military, american express gold card benefits, military gold card, amex military benefits, american express platinum card, amex gold card benefits

0 Comments